AI is now a central force in B2B research. Buyers are doing more on their own, sales cycles are stretching, and trust in vendors is under pressure.

The B2B landscape has changed, but many go-to-market teams haven’t caught up. Legacy playbooks assume vendors control the narrative. That’s no longer the case. Buyers are driving, and they’re overwhelmed. GenAI is changing the game, and software vendors must remain relevant and discoverable. This report breaks down what’s actually happening in the market: how buyers are behaving, what they expect, and what’s getting in their way. Time to understand the real shifts that are already here.

Let’s get into it!

Reduce the complexities of B2B buying processes.

Customers need help and guidance in overcoming their buying challenges.

Develop a more consumer- like experience for tech buying customers.

Meet the Modern B2B Tech Buyer

B2B buyers are more empowered than ever, but buying software is still complex.

The B2B buying process isn’t working as well as it should for both buyers or sellers. As buying behaviors evolve, providers need to shift their approach. That means moving beyond legacy go-to-market strategies and focusing on helping buyers make informed, confident decisions through clearer, more useful experiences.

- 75% of companies plan to increase their software spend in 2025. Yet the journey is rarely smooth.

- B2B buying isn’t linear. Buyers loop between stages—research, validation, comparison—making it tough for sellers to engage at the right moment.

- 27 touchpoints: That’s the average number of interactions a B2B buyer has with vendors before making a decision. Attribution? Still broken.

- 70% of B2B buyers prefer digital or remote interactions over in-person meetings. They expect intuitive, self-directed journeys.

- 10+ channels are used by B2B buyers to interact with suppliers. Seamless omnichannel experiences are now the expectation.

- Only 5% of B2B buyers are “in market” at any given time. You must build brand awareness long before they’re ready to buy.

Search is no longer what it used to be.

AI Overviews, zero-click results, and LLM-powered summaries are reshaping how buyers discover and evaluate information. Traditional SEO still matters, but if you want to stay visible in this new landscape, you need to adapt your playbook.

- Open the door for AI crawlers

If models cannot access your site, you disappear. Allow Google-Extended and similar crawlers, keep internal linking clean, and avoid unnecessary blocking tags. - Build a trusted brand entitiy

Models lean on authority. Ensure your brand is consistent across the web, strengthen backlinks and PR mentions, and connect your company to trusted knowledge graphs.

- Structure content for AI comprehension

AI rewards clarity. Use proper heading hierarchies, FAQ schema, and concise Q&A formats so your content can be parsed and surfaced.

B2B Buying Groups:

Who are the Decisionmakers?

What about timelines?

- 87% of buyers say purchases are completed in under 6 months.

- But for enterprise, only 65% wrap up in that time — though 87% finish within 12 months

- On the vendor side, 70% of deals close within 6 months, with 89% done in 10 months.

The modern B2B buyer journey isn’t a solo act. Most buying decisions are made by groups of 2 to 5 people, especially in mid-sized and enterprise companies. But influence doesn’t stop at the core group — departments like legal, procurement, and finance often weigh in, even if they’re not officially part of the buying team.

In small businesses, 2–3 person buying groups are most common (53%)

In mid-sized companies, they show up 39% of the time.

In enterprise, groups tend to be slightly larger — 4–5 people (34%).

Interestingly, senior decision-makers are playing a bigger role: 52% of buying group members now hold VP titles or higher, suggesting more experienced buyers, shorter approval chains, and a preference for established solutions.

There’s also a slow shift in group size: One-person buying groups grew by 3%, while 2–3 person groups declined at the same rate. Large enterprise buying groups (20+) are shrinking as companies streamline.

To win today’s B2B buyers, you need to reach across departments,connect with senior decision-makers, and stay visible at every step, from first touch to final decision.

Where B2B Tech Buyers Are

Looking (And Why It Matters)

B2B buyers are relying less on sales reps and more on digital, AI-assisted, and peer-driven research.

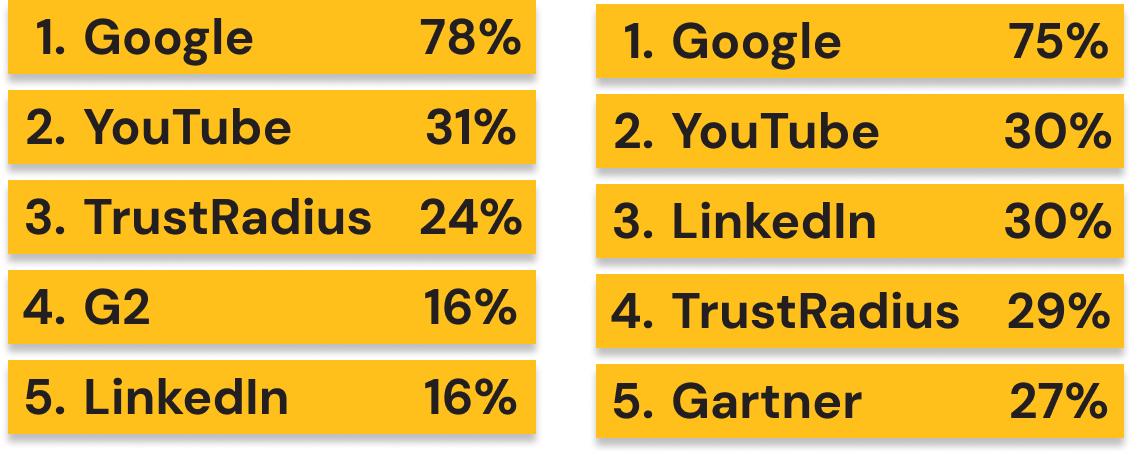

WEBSITE BUYERS VS ENTERPRISE BUYERS

NOTE: The data is still

young, but LLMs are a rising

source that will likely soon

top league tables like these.

Modern B2B buyers are in control, and they’re spending more time researching independently across multiple touchpoints. The challenge for vendors? You can’t just be present — you have to be visible in the right places, at the right times, and with the right level of trust.

of buyers use AI tools like ChatGPT to research software – and 98% say they’re impactful. HubSpot’s 2025 B2B Buyer Survey reveals that almost half of buyers used AI-based tools for software research, and nearly all of those found them use.

B2B Buyer Journey: Breaking Down the Software Buying Process

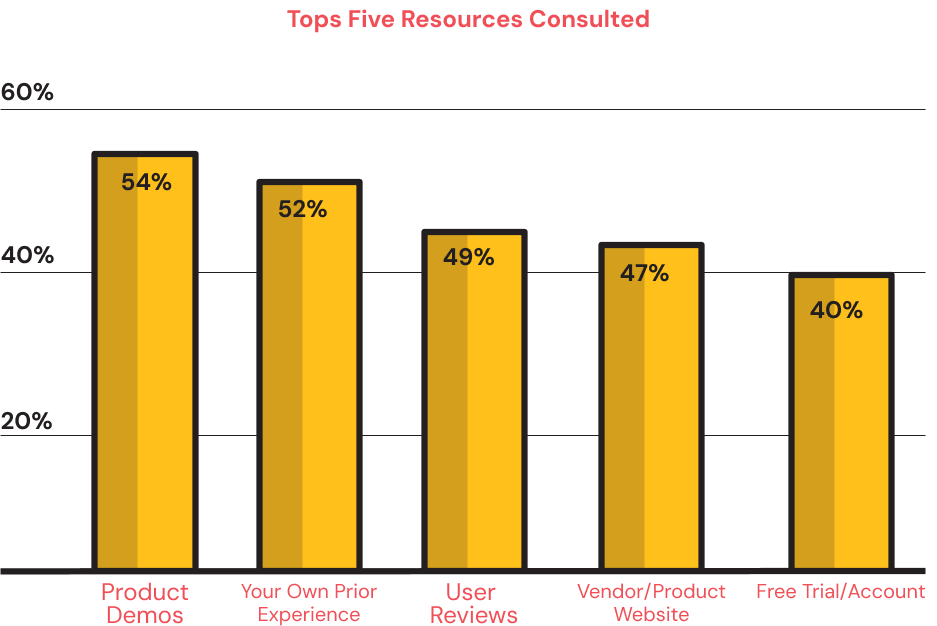

Research from Capterra and TrustRadius offers a clear snapshot of how software buying really happens:

- 50% more likely to rely on past experience with the software vendor.

- TrustRadius reports that 73% of organic traffic goes straight to high-intent pages like pricing, reviews, and comparisons. 56% of those visitors are planning to buy within the next three months.

- 63% of B2B buyers include just two to three products in their shortlist. 96% include five or fewer.

- 50% more likely to use product comparison websites and expert reviews during their research. These channels offer clear, structured insights that help simplify decision-making

- Once buyers narrow their list, 71% go with their first choice. When you combine that with the fact that Google is where most research begins, it’s clear: strong brand recognition and early discoverability are your competitive edge.

- 57% of B2b buyers make a decision within 3 months, while regretful buyers (54%) take 5 months or more.

The implications are clear: Top-of-mind brands with strong SEO and brand-led growth strategies consistently outperform competitors. If you’re not on the shortlist, you’re not in the running.

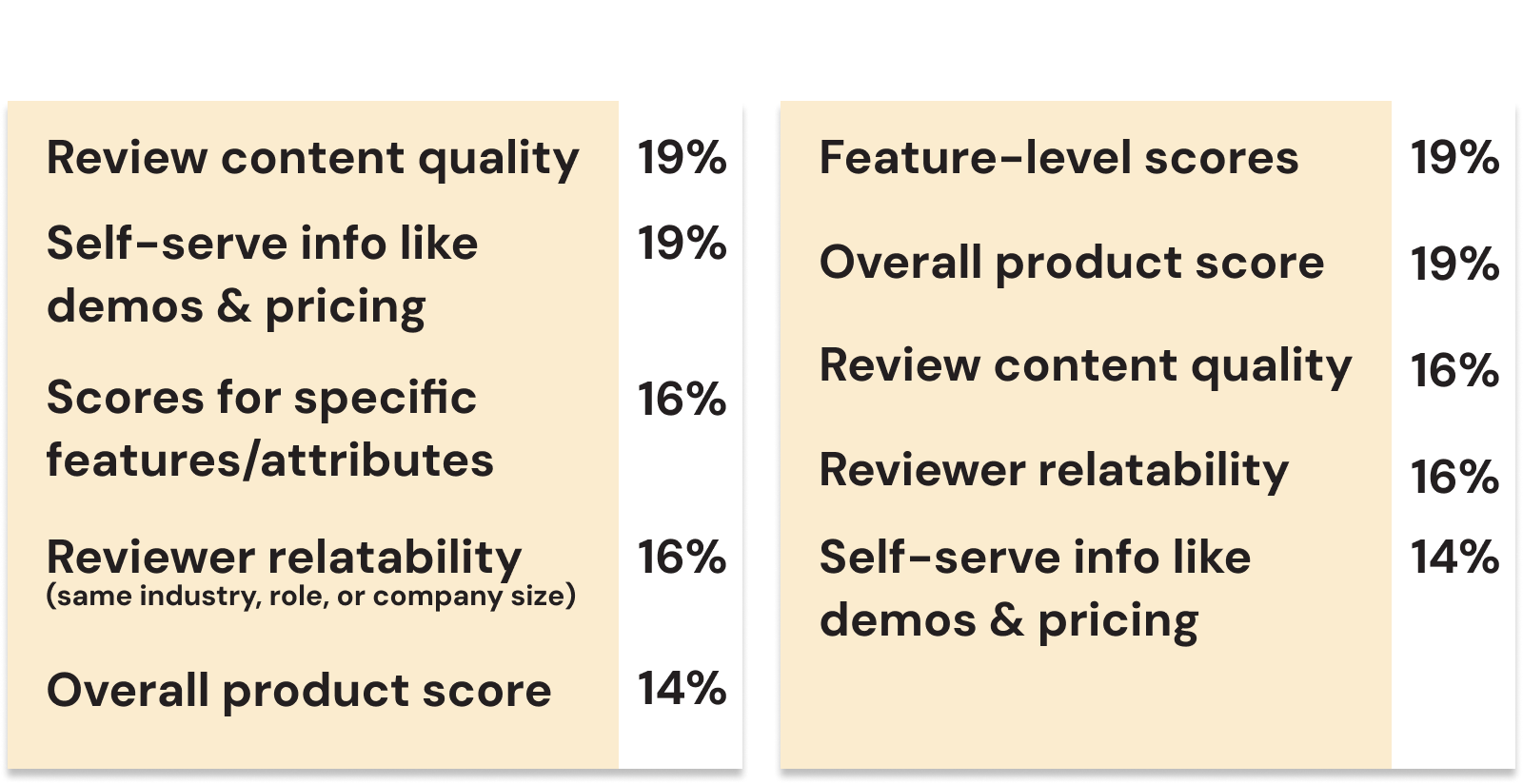

Where B2B Tech Buyers Are

Looking (And Why It Matters)

When buyers do trust a review site, here’s what they care about most:

If your product has a free version, promote it early and often, buyers will self-qualify before they ever talk to you.

Free Trials and Demos: Key Drivers in B2B Buying Decisions

Research from Capterra and TrustRadius offers a clear snapshot of how software buying really happens:

- 40% of B2B buyers used a free trial or free version during the buying process.

- 74% of those trial users said it was the most influential part of their research.

- 78% of buyers had already heard of the product they eventually purchased before starting their research.

- At the beginning of the buying journey, familiarity drives discovery, and demos help validate use cases and must-have features.

B2B buyers want to try before they buy. Hands-on experience with a product can help them to make a confident purchase decision.

How GenAI is Deeply Embedded in the B2B Tech Buying Journey

GenAI adoption numbers are going nowhere but up. AI is inescapable.

- 89% of B2B buyers use generative AI at some point in the buying process. They rely on it not just for discovery, but for evaluation and justification.

- Buyers say GenAI is one of the most impactful tools for evaluating vendors.

- GenAI lets buyers do more research, faster. Among those using GenAI in their purchase journey, 87% say it led to better business outcomes.

- 48% of buyers use GenAI tools routinely (monthly or more). 66% say they use these tools in their job.

- Yet adoption is uneven. Only 21% of tech buyers in one study used GenAI during their purchase process—and some weren’t sure it helped.

We’re still seeing a knowledge gap: many vendors wrongly assume AI models can access gated content. In truth, LLMs are trained only on publicly available data. If your content is locked behind forms or login walls, it’s unlikely to surface in AI-generated summaries. To stay visible, brands must prioritize ungated, high-quality content that’s easy for both humans and AI to access.

Today’s buyer asks GenAI before they ask your sales team. It isn’t just shaping how buyers research, it’s reshaping how brands must show up. Don’t be invisible.

KEY TAKEAWAYS

GenAI adoption numbers are going nowhere but up. AI is inescapable.

The buyer journey has changed. The brands who adapt will be found first, and trusted most.